In the previous post, we introduced three perspectives—Fiction, Domains, and Relations—as frameworks for understanding the world and shaping the future in a meaningful way.

In this post, we present the basic structure of the Balance Sheet (BS), a highly effective tool for applying those three perspectives to gain a bird’s-eye view of the world. We also introduce examples of how BS can be used to analyze various phenomena.

1. What Is the Basic Structure of the Balance Sheet?

What is a Balance Sheet (BS)?

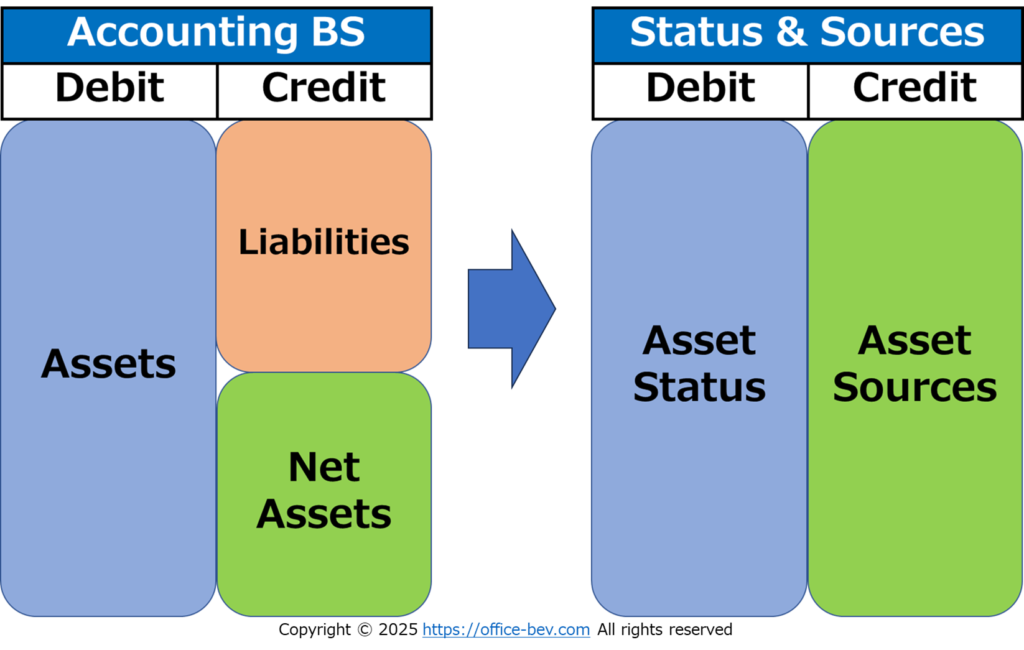

A balance sheet is a key indicator of a company’s financial status. It consists of two parts, Debit and Credit:

- Debit (Assets): Resources held by the company that have economic value

- Credit (Liabilities): Obligations the company owes to others

- Credit (Net Assets): Assets belonging to the owners, with no repayment obligations

The essence of a BS lies in its structure: it reveals both the status of the assets (debit) and the sources of those assets (credit).

Abstracting the BS: A Universal Framework

By further abstracting the structure of a BS, we can define it as:

- Debit (Assets) = What you have (Asset Status)

- Credit (Sources of Assets) = How you obtained it (Asset Sources)

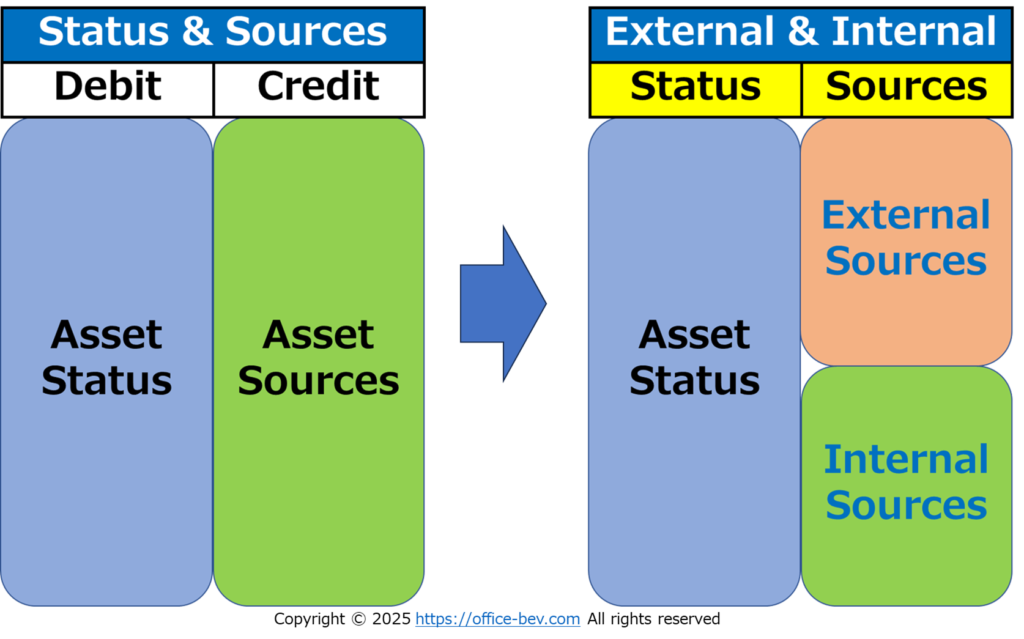

These sources of assets can be divided into two categories:

- Liabilities = External Sources: Provided by others, involving obligations

(e.g., bank loans, bonds, accounts payable, etc.) - Net Assets = Internal Sources: Generated from within, no obligations

(e.g., capital, retained earnings, etc.)

Thus, the credit side of the BS can be understood as a binary framework consisting of:

- External = Assets sourced from outside (with repayment obligations)

- Internal = Assets generated internally (without repayment obligations)

2. BS as a Tool for Applying the Three Perspectives

In the previous post, we introduced the approach of understanding the world through the lenses of Fiction, Domains, and Relations (see link below).

The BS’s binary framework of status/sources and external/internal proves to be a powerful tool for deeply understanding and applying these perspectives.

- ✅ Fiction: The BS allows us to frame assets as either “fictional” or “real.” It also helps analyze whether a value is an internally generated belief or externally imposed fiction, using the internal/external distinction.

- ✅ Domains: By applying the debit-credit framework and internal/external classification, we can flexibly define and analyze various domains based on asset flows and balances.

- ✅ Relations: The BS enables analysis of relative relationships—between assets and their sources, internal and external sources, or even between multiple balance sheets (e.g., self vs. others).

In short, the BS serves as a universal tool for visualizing the structure of these perspectives and organizing them into analyzable frameworks.

3. Applying the BS Binary Framework

By using the internal/external lens, we can extend the BS framework beyond accounting to analyze various domains. Below are four examples:

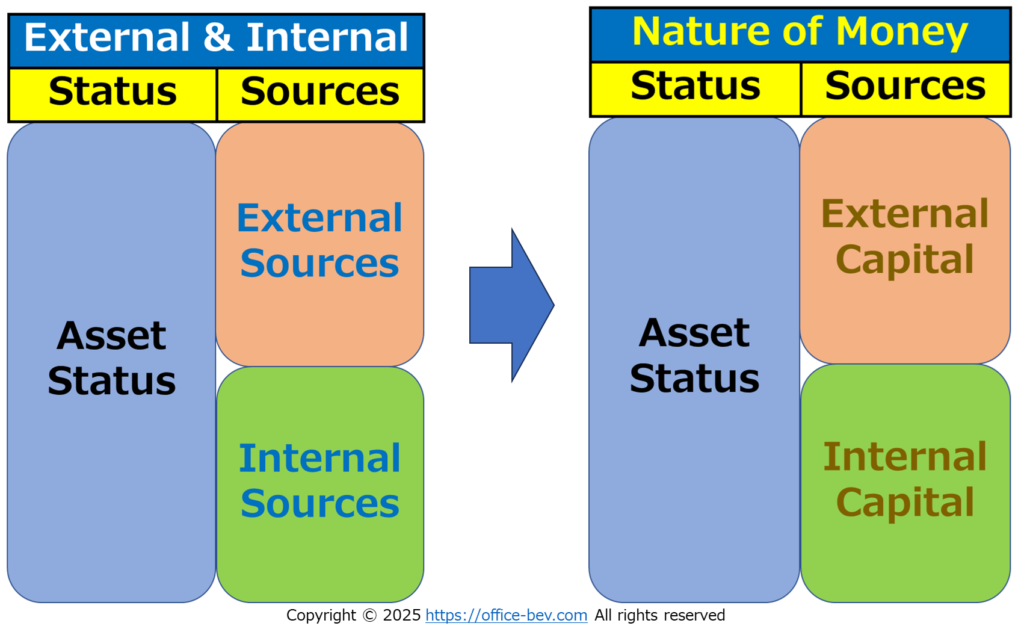

(1) The Nature of Money

This is the BS’s original territory and can be structured as:

| External Capital (Liabilities) | Internal Capital (Equity) |

|---|---|

| Loans, debt, payables, etc. | Capital, retained earnings, etc. |

For instance, a company that grows through external loans (external capital) will have a vastly different strategy from one that grows through self-financing (internal capital).

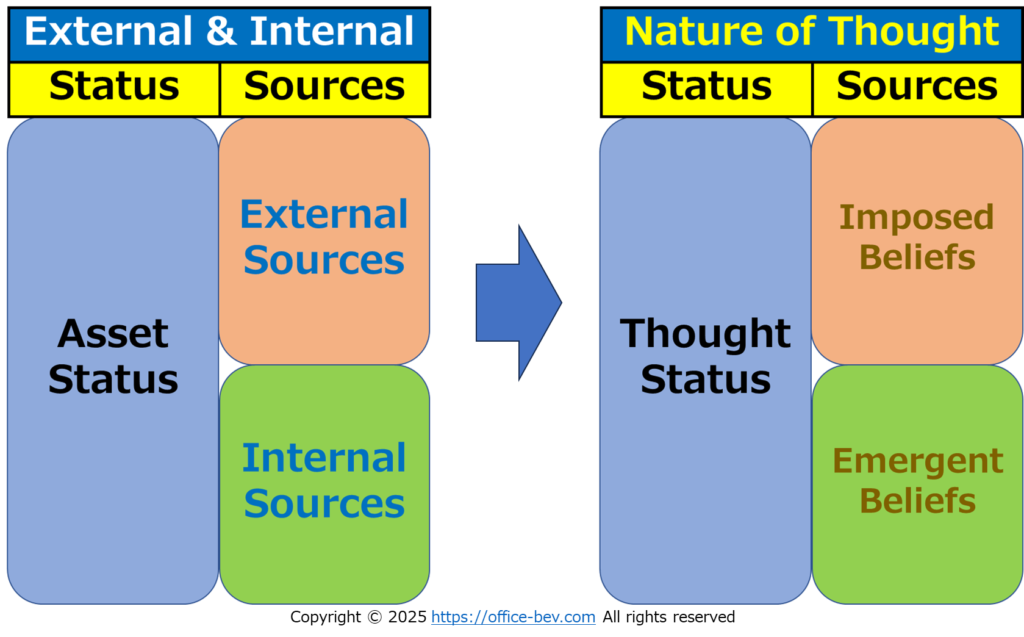

(2) The Nature of Thought

Beliefs and ideologies can also be classified this way:

| Imposed Beliefs (External) | Emergent Beliefs (Internal) |

|---|---|

| Social norms, education, etc. | Personal reflection, experience, etc. |

For example, “Hard work always pays off” may be an imposed belief instilled through social norms, whereas emergent beliefs formed through personal experience shape one’s core values.

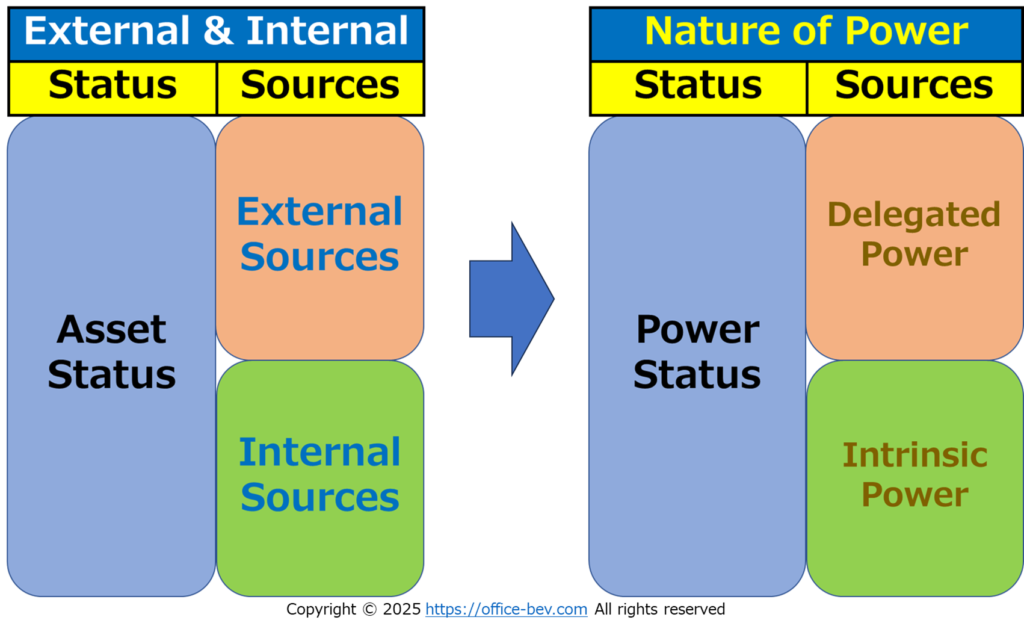

(3) The Nature of Power

The source of power can also be analyzed:

| Delegated Power (External) | Intrinsic Power (Internal) |

|---|---|

| Titles, positions, authority, etc. | Personal charisma, competence, etc. |

For instance, authority based on one’s job title is externally granted, while influence stemming from character or actions is internally generated.

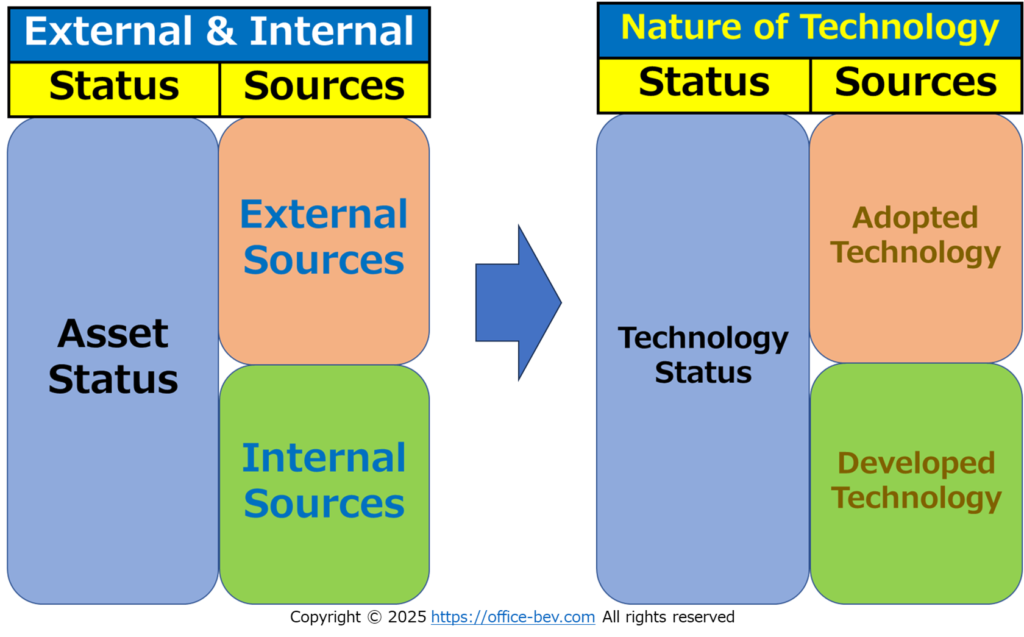

(4) The Nature of Technology

Technology can be framed by its source:

| Adopted Technology (External) | Developed Technology (Internal) |

|---|---|

| Systems adopted from others, etc. | Proprietary technologies, R&D outcomes, etc. |

Introducing new IT systems from outside is an external acquisition, while developing unique algorithms in-house is an internal innovation.

4. Conclusion

In this post, we explored the basic structure of the BS by abstracting it beyond its traditional accounting role. We demonstrated:

- BS consists of a binary framework: asset status (debit) vs. asset sources (credit)

- The credit side can be further divided into external (with obligations) and internal (without obligations)

By applying this binary framework, we showed how the BS can be a universal tool for analyzing fields such as money, thought, power, and technology, and more.

Furthermore, we connected this to the three perspectives—Fiction, Domains, and Relations—from the previous post.

Ultimately, the BS is not merely a financial tool—it is a powerful lens for understanding the structure of the world.

1 thought on “The Fundamental Structure of the Balance Sheet”

Comments are closed.