A conceptual framework to decode the world through balance sheet thinking—across domains, structures, and relationships.

1. Introduction: The Expanding Scope of BS Thinking

In the past three posts, we explored the following perspectives:

・We introduced three analytical lenses—domain, fiction, and relation—as fundamental to interpreting the structure of the world. These three perspectives form a dynamic loop that continuously reshapes our reality. This loop is not fixed; it allows for what we called “domain jumps”—shifts that act as catalysts for paradigm change and the emergence of new systems or ways of seeing.

・We examined the basic structure of the balance sheet (BS) as a dual framework of “asset status (debit side)” and “sources of assets (credit side).” Further dividing the credit side into external and internal sources allows us to generalize the BS beyond accounting, applying it to fields like thought, power, and technology. The BS thus becomes a universal tool for structural analysis.

・We reinterpreted the BS not as a static ledger of assets and liabilities, but as a dual structure—a synthesis of realized stock and fictional value sustained by trust. The BS reflects not only “what is” but also “what is believed to be.” In this view, fiction is not deception but a shared belief system that powers coordination, investment, and collective imagination.

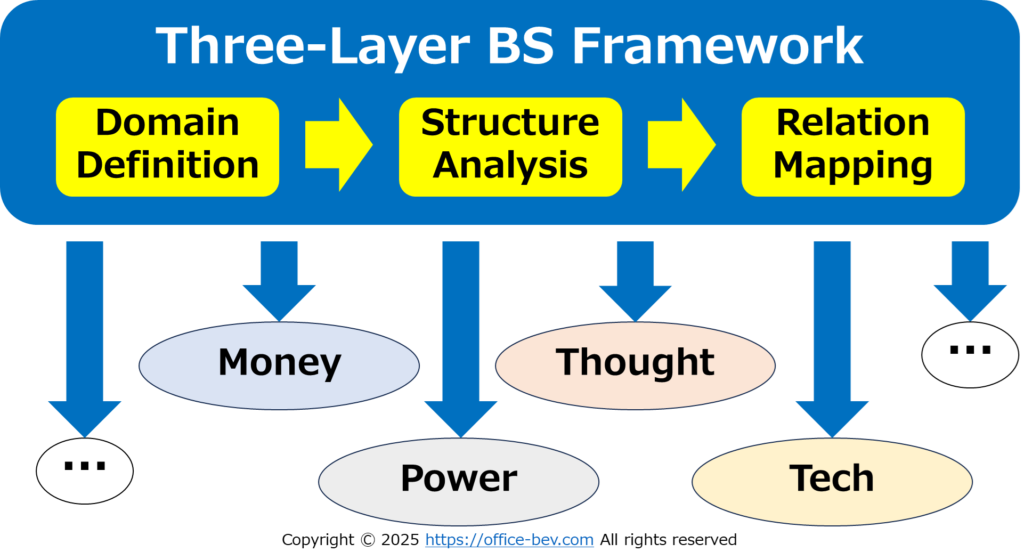

Building on these perspectives and the foundational BS structure, this post introduces a unified framework for analysis: the Three-Layer BS Framework.

This framework unfolds in the following three steps:

2. The Structure of the Three Layers

The Three-Layer Framework is a structured progression of the three perspectives introduced in earlier posts: domain, fiction, and relation. Each is an independent analytical lens, but together they form a continuous and interconnected flow.

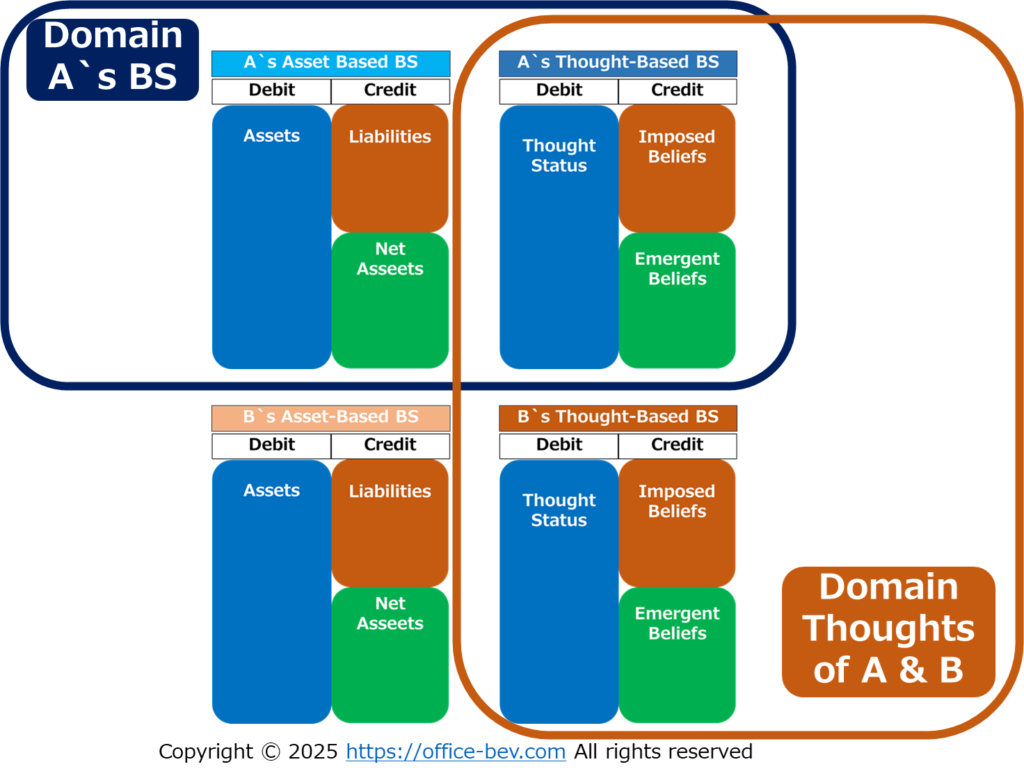

Layer 1: Whose BS? And of What? — Defining Perspective and Domain

The first step in analysis is to clarify whose perspective we take and what we are observing—that is, the subject and object of the analysis.

- Are we looking at the BS of a nation, a corporation, or a household?

- Is the focus on fiscal policy, labor, currency, ideology, or technology?

This configuration of “perspective × domain” determines the analytical focus of the BS. It corresponds to the first of the three core lenses: domain.

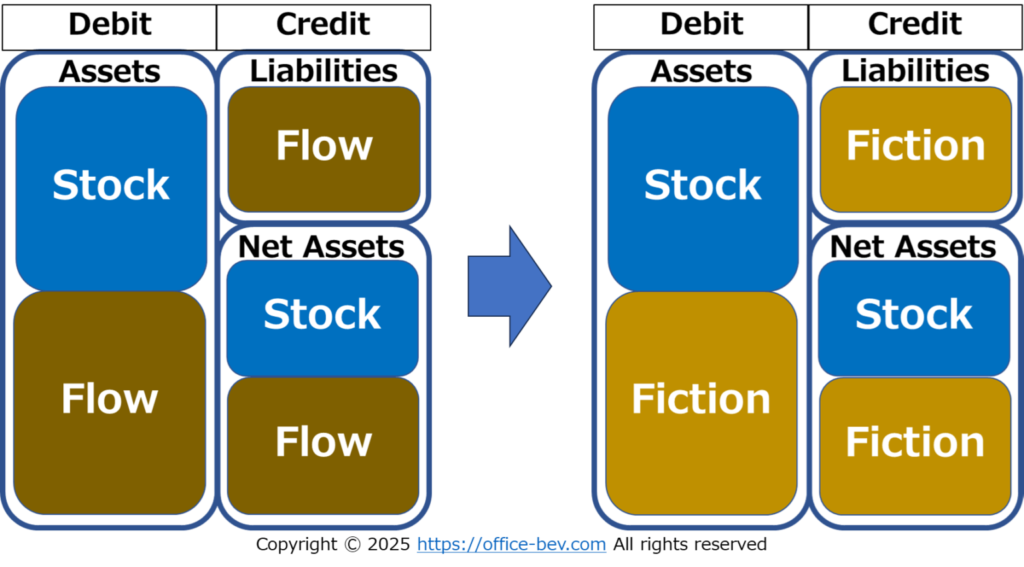

Layer 2: What Is It Made Of? — Stock and Flow (i.e., Fiction)

Next, we examine the internal structure of the BS. Here, we classify components into:

- Stock: Values already realized and settled

- Flow (i.e., Fiction): Structures based on expectations and trust—claims and obligations that are believed to yield value in the future

This distinction allows us to make visible both the ontological status of value (realized or expected) and the trust-based framework that supports it.

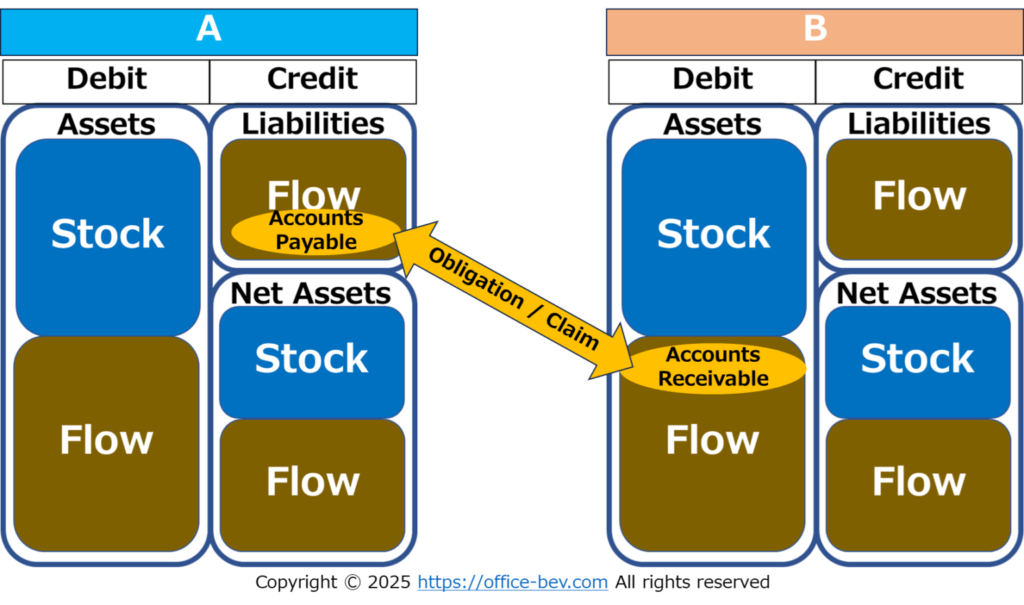

Layer 3: With Whom? And How? — The Structure of Relation

Finally, we ask: With whom are these BS items in relation? The BS is never a closed system—it always exists in a network of counterparties.

This layer naturally follows from the previous one. If flows (i.e., fiction) are built on claims and obligations, then we must ask: Who are these claims and obligations tied to? What kind of relational structure supports them?

- Which counterparty is involved in the value realization?

- Are the relationships externally driven or internally constructed?

- Are they consolidated within the same domain or formed with external actors?

This layer allows us to trace not just internal BS logic, but also its legal, institutional, and geopolitical interconnections.

3. Applying the Framework Across Domains

This three-layer framework is broadly applicable beyond finance and accounting. It can be extended to areas such as:

- Fiscal and monetary structures of the state: Central government vs. citizens, domestic vs. foreign domains, and more.

- Technological and data architectures: Platforms, cloud infrastructures, user relationships, and more.

- Ideological and value systems: Modern vs. postmodern, individual vs. collective, mainstream vs. dissent, and more.

- Structures of power and governance: Sovereignty, surveillance, institutional design, rule-making, and more.

These themes were briefly explored in previous posts, but we will revisit them in more depth using this new framework.

In every domain, we apply the same core questions:

Whose structure are we analyzing? What is it composed of? And how is it relationally embedded?

These questions align directly with the three steps of the Three-Layer Framework:

Whose structure—and of what—is being analyzed? ― Domain Definition

What is it made of? ― Structure Analysis

With whom, and how, is it connected? ― Relation Mapping

In this way, the Three-Layer Framework serves as an analytical skeleton, linking each core question to a corresponding structural layer.

4. Conclusion: Connecting Past Posts and the Next Steps

Having reviewed the perspectives developed in the previous three posts, this article presents the Three-Layer Balance Sheet Framework as a unifying structure.

In the upcoming articles, we will further reinforce this framework by organizing the typology of assets and the patterns of asset increase and decrease within the BS. These classifications will clarify the internal mechanics of the BS and serve as a foundation for the next phase: applying the framework to interpret concrete systems—starting with the structure of money and expanding into broader domains such as national governance and global relations.

By moving from structure to classification to application, this framework aims to provide a consistent and transferable lens through which to analyze diverse aspects of the world.