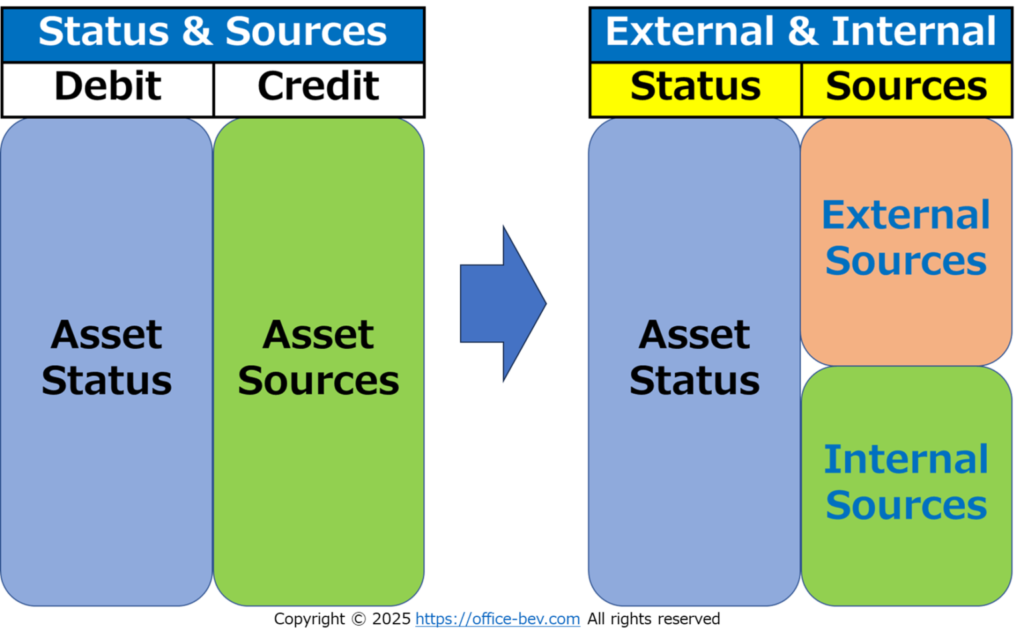

External & Internal

In this post, we explored the basic structure of the BS by abstracting it beyond its traditional accounting role. We demonstrated:

BS consists of a binary framework: asset status (debit) vs. asset sources (credit)

The credit side can be further divided into external sources (with obligations) and internal sources (without obligations).

By applying this binary framework, we showed how the BS can be a universal tool for analyzing fields such as money, thought, power, and technology, and more.

Furthermore, we connected this to the three perspectives—Fiction, Domains, and Relations—from the previous post.

Ultimately, the BS is not merely a financial tool—it is a powerful lens for understanding the structure of the world.

→ See the full article :

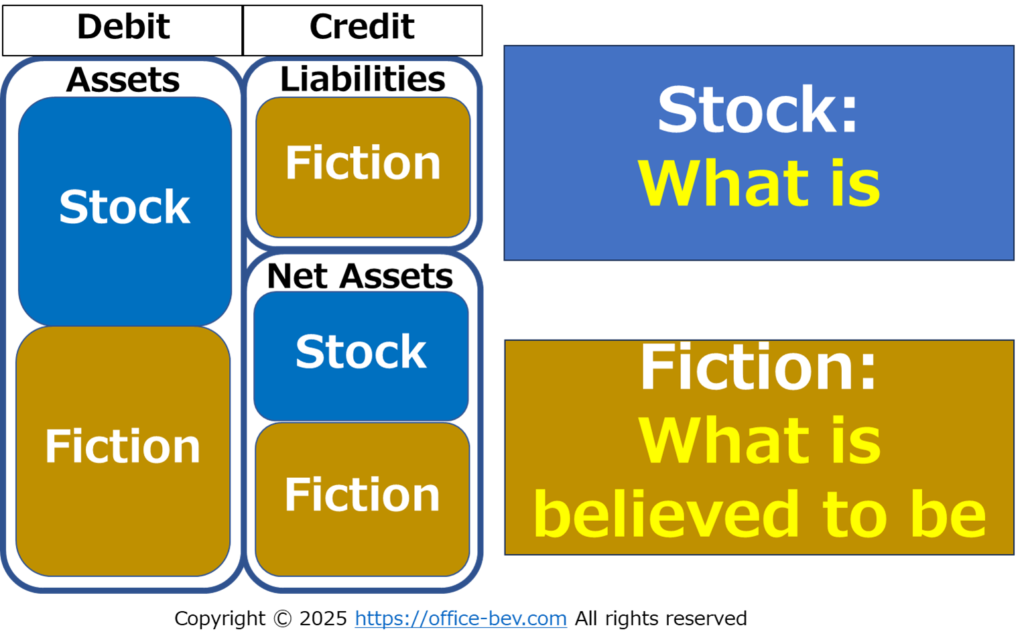

Fiction & Stock

The balance sheet is more than a static record of assets and liabilities. It is a dual structure: a synthesis of realized stock and fictional value grounded in social trust. By interpreting the BS in terms of what is and what is believed, we uncover the deeper foundations of modern financial systems—where fiction, far from being deceptive, becomes the engine of coordination, investment, and collective imagination.

→ See the full article :

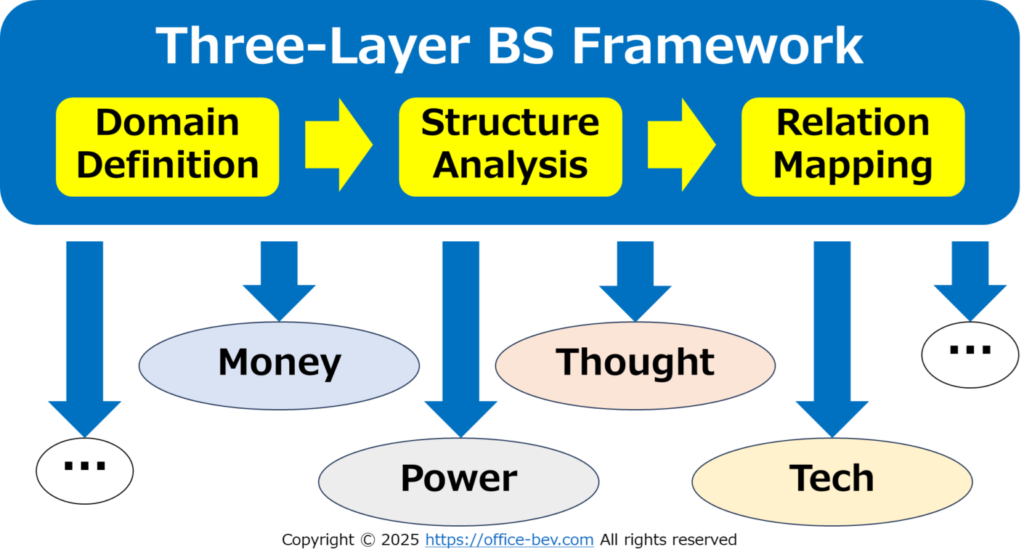

Three-Layer Balance Sheet Framework

The Three-Layer Framework offers a conceptual lens to interpret the world through balance sheet thinking—across domains, the structures of fiction and stock, and relational dynamics.

Each layer functions as an independent analytical perspective, yet together they form a continuous and interconnected flow: domain definition, structure analysis, and relation mapping.

Through this framework, we apply the same fundamental questions across a wide range of phenomena:

Whose structure are we analyzing? What is it made of? And how is it embedded in relations?

→ See the full article :

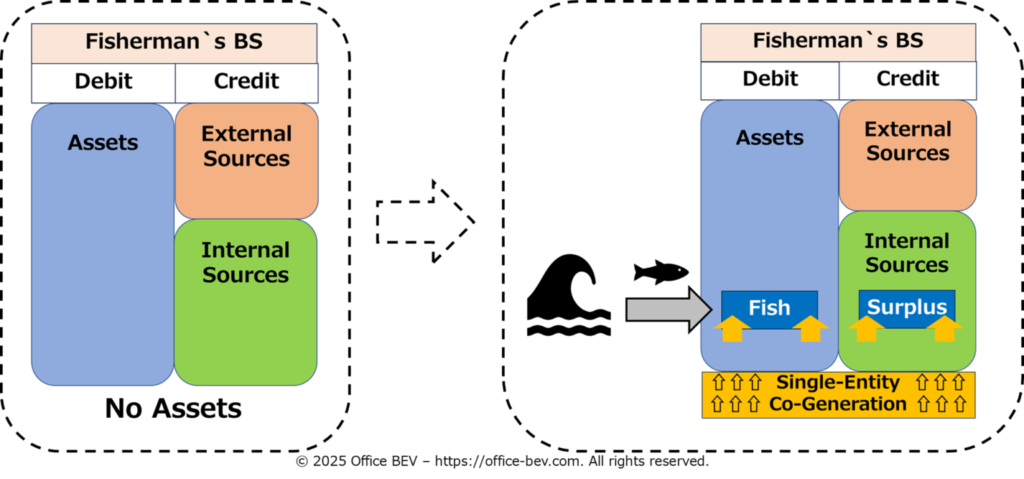

The Genesis of Assets — Where Stock and Flow Begin

How are assets created from nothing?

This article explores the very beginning of asset formation using the Three-Layer BS Framework. It introduces the dual processes of asset creation—within a single entity and between entities—and reveals how stock assets and flow assets first emerge.

By tracing this layered genesis, the article lays the groundwork for the next in the series: an exploration of the structural nature of assets within the balance sheet.

→ See the full article :

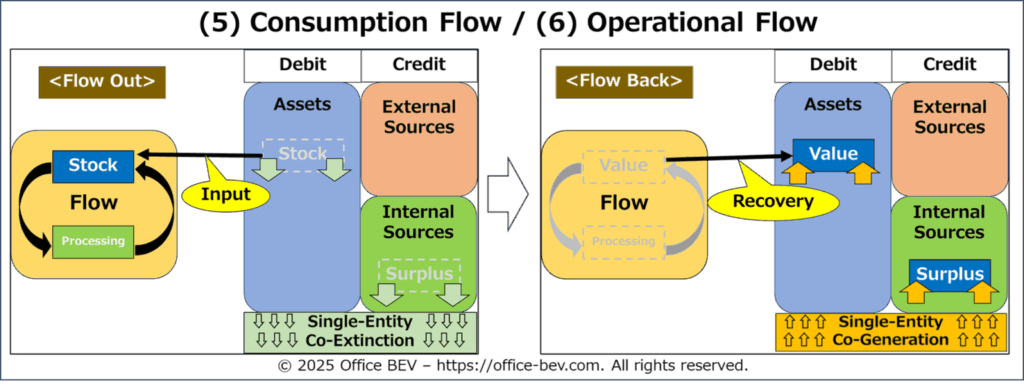

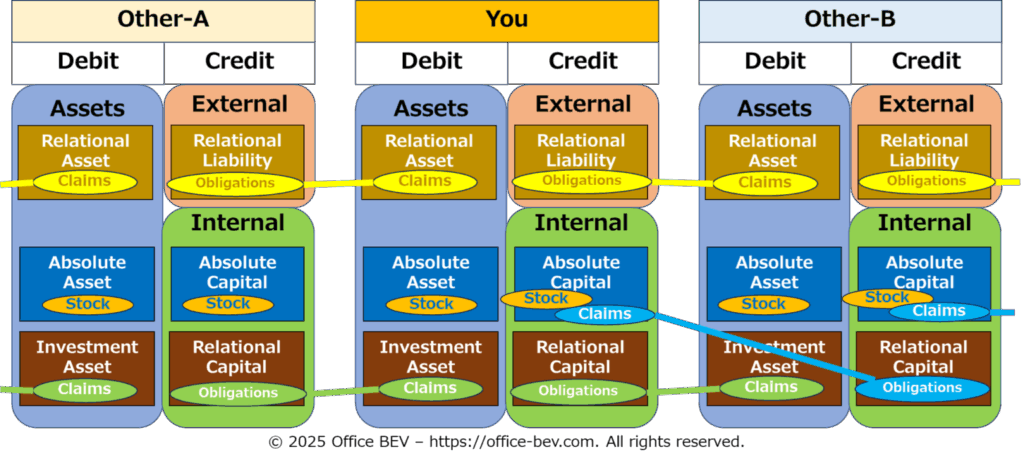

The Structure of Assets — The Forms of Stock and Flow

This post explored how assets, once generated, take on distinct structural forms—and how those forms can be systematically classified within the BS. We organized these patterns along two axes: Stock vs. Flow, and Single-Entity vs. Inter-Entity.

From this, we identified eight types of asset movements—four stock-based and four flow-based—each representing a unique way in which assets are created, moved, and recovered.

These movement patterns then informed a structural reclassification of the BS into six asset typologies: three on the debit side (Asset Status) and three on the credit side (Asset Sources).

This framework goes beyond conventional accounting terms and redefines the BS as a dynamic structure of generation and transformation.

Yet one fundamental question remains:

Where does surplus come from?

In the next post, we will explore the nature of surplus—the “increase” that appears through these asset flows—and how it relates to both productive activity and inter-entity trust.

→ See the full article :

→ See Visual Guide to Asset Structures :